A firm’s management will instead compare its DPO to the average within its industry to see if it is paying its vendors too quickly or too slowly. However, a low DPO may also indicate that the company is not taking advantage of discounts offered by suppliers for early payment. Every business buys supplies for production as well as for day to day operation of the company. If you are running a small business, you will receive bills and invoices from your suppliers and vendors. If you want to have a good reputation in the market, it is essential that you manage your payable account well.

Average Payment Period Analysis

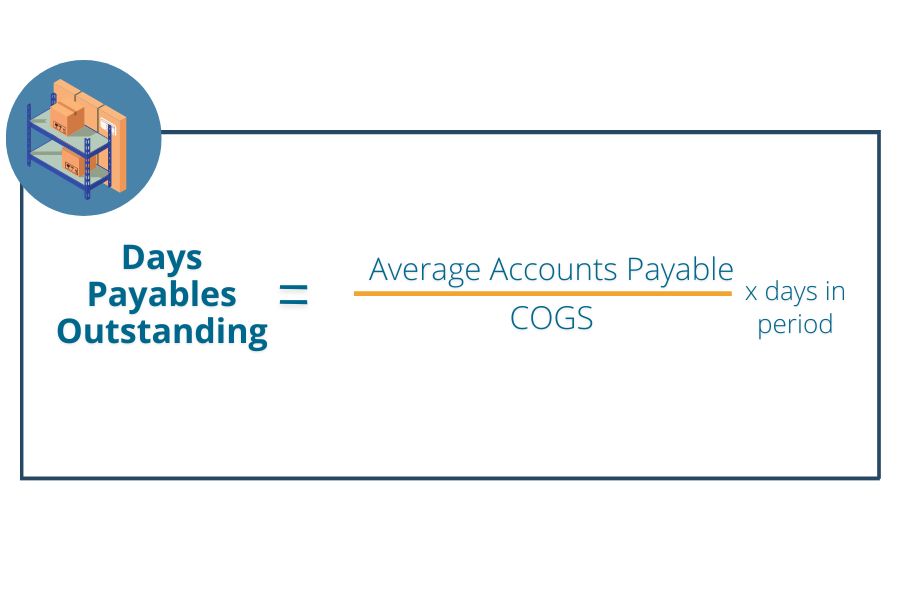

Imagine if a company allows a 90-day period for its customers to pay for the goods they purchase but has only a 30-day window to pay its suppliers and vendors. The number of days in the corresponding period is usually taken as 365 for a year and 90 for a quarter. The formula takes account of the average per day cost being borne by the company for manufacturing a salable product.

Average Payment Period – The Specifics

- You can calculate the remaining components of the APP formula once you know the average accounts payable.

- For instance, if the balance is paid by the due date specified by the supplier, a business may receive a 10% discount on its purchases from the supplier.

- It’s a financial metric that measures the average number of days it takes a company to pay its suppliers for goods and services received.

- A longer than average payment period allows the company to use its cash for other operations before settling its payables.

It is very important to compare the ratio with the ratio of different other companies in the same industry and to study the trend of this ratio in the company itself[2]. For example, a company can see whether its DPO is improving or worsening over time and make the appropriate course of action accordingly. By using electronic payment systems, a company can streamline its payment processes and make payments more quickly and efficiently. This means that instead of issuing slower means of payment such as a check that may have to be processed and mailed early in order for it to be received in time. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Is it better to have a high or low DPO?

If the turnover ratio declines from one period to the next, this indicates that the company is paying its suppliers more slowly, and may be an indicator of worsening financial condition. A change in the turnover ratio can also indicate altered payment terms with suppliers, though this rarely has more than a slight how to report backdoor roth in turbotax impact on the ratio. If a company is paying its suppliers very quickly, it may mean that the suppliers are demanding fast payment terms, or that the company is taking advantage of early payment discounts. Divide the result of dividing the total credits by the time period by the average accounts payable.

Average Payment Period Formula

Average payment period in the above scenario seems to illustrate a rather long payment period. Assume that Clothing, Inc. can receive a 10% discount for paying within 60 days from one of its main suppliers. The company management team would need to evaluate this to see if there is adequate cash flow to cover the purchase in 60 days.

Real-World Example of DPO

Understanding your industry’s benchmarks is crucial for businesses to assess their own DPO in the context of their sector and strive for optimization. Companies must balance maintaining a healthy DPO that benefits their cash flow while nurturing positive relationships with suppliers. This can be somewhat tough to achieve when the company does not only need to keep on good terms with suppliers but also needs to consider its internal working capital and available cash flows.

DPO takes the average of all payables owed at a point in time and compares them with the average number of days they will need to be paid. The accounts payable turnover ratio is a liquidity ratio that shows a company’s ability to pay off its accounts payable by comparing net credit purchases to the average accounts payable during a period. In other words, the accounts payable turnover ratio is how many times a company can pay off its average accounts payable balance during the course of a year. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable. In other words, the ratio measures the speed at which a company pays its suppliers.

The net factor gives the average number of days taken by the company to pay off its obligations after receiving the bills. A company’s APP ratio is used by shareholders, investors, and other financiers to assess whether it has sufficient incoming revenue to cover short-term liabilities and how quickly the business can pay them off. Investors can use this information to determine whether it is advantageous to fund business ventures.

With this knowledge in hand, it’s up to you to forge onward and harness the power of these insights to steer your business towards greater success. Finally, we’ll wrap up with concluding thoughts on maintaining a harmonious balance between customer satisfaction and efficient payment procedures. Strategically managing the Average Payment Period can contribute greatly to a company’s financial efficiency.

It requires a fine-tuned balance between maintaining good customer relationships and ensuring prompt payments that guarantee financial stability. An understanding of key performance indicators, industry averages, and the intricate dynamics of DSO can be instrumental in achieving this balance. These figures provide essential insights and realistic expectations for your own payment terms. Benchmarking your average payment period against these industry averages allows for more accurate forecasting, and helps in crafting effective strategies to manage credit risk and improve cash flow.

During the accounting year 2018, Company A ltd, made the total credit purchases worth $ 1,000,000. For the accounting year 2018, the beginning balance of the accounts payable of the company was $350,000, and the ending balance of the accounts payable of the company was $390,000. Average payment period is the average amount of time it takes a company to pay off credit accounts payable.